Ever imagined that transferring money from your PayPal account to an Equity Bank would one day become this easier? Now you can instantly move your money from a PayPal account to an Equity bank account instantly right on your mobile phone. Most of us who accept payments via PayPal have found great solace from the service which initially would complete these transactions within 24hrs but now happens instantly the moment you press the withdraw button. If you’ve been looking for a comprehensive guide on how you can instantly withdraw your PayPal earnings to an Equity bank account, then this guide is tailored for you. Follow this comprehensive step-by-step guide to seamlessly transfer your PayPal funds to your Equity Bank account in just a few simple steps.

1. Get the Equity Mobile App

If you haven’t already downloaded and installed the Equity Mobile App from either the App Store or Google Play Store depending on your smartphone, head over to the respective app store and install the mobile app on your device. Make sure that the app you choose to download is developed by Equity Bank Kenya for security and reliability reasons. Don’t fall prey to third party apps that may harvest your details for other usually malicious use.

2. Sign into Your Equity Bank Account

This step only applies to those of us who already have an Equity mobile app installed on their devices and have been using for other services such as making payments or transferring money to other banks or mobile money. Open the Equity Mobile App and proceed to login using your account details. You might need to confirm your identity through a text message, card number or security questions depending on how you set it up. Be sure to use the correct credentials or signup if you haven’t already.

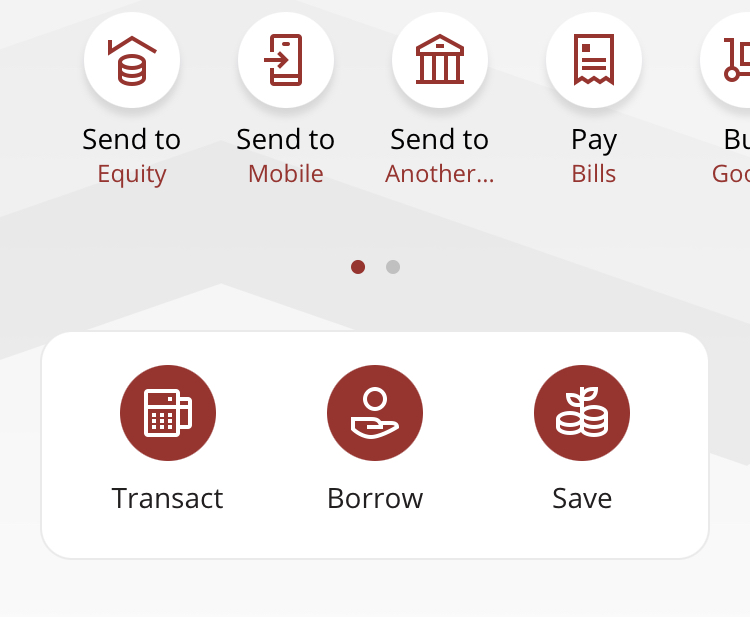

3. Go to the “Transact” Section

Once you have managed to login, head over to the “Transact” section of the app, it’s usually located at the top of the app. This area usually offers additional financial transaction options like transfers and payments. Here is where you’ll find the PayPal option alongside others such as Western Union and so-on.

4. Choose “Remittance”. Then Select “PayPal”

Scroll down until you see “Remittance” tap on it then pick “PayPal” as your withdrawal method within that section. If your PayPal account isn’t linked to your Equity Bank account yet you might want to get that done now before proceeding. A couple of things to note here, your PayPal account names must match those you used to open your Equity bank account. I usually advise people to just make sure that for whatever reason, they use their names exactly as they are on their National Identification Card.

5. Providing Withdrawal Details

When you choose “PayPal ” you’ll need to fill in the withdrawal details. Make sure your PayPal email address is accurate and the linked Equity Bank account where you want the funds to go. Input the amount you wish to withdraw in USD, could be any amount such as $100.

6. Starting the Withdrawal Process

After entering all the required information, click on the “Withdraw” button to start the withdrawal process. The Equity Mobile App will show you the exchange rate used for the transaction and any applicable commission charges it’ll take for withdrawing.

7. Confirming the Transaction

For security reasons Equity Bank uses a two-factor authentication system. You’ll receive a confirmation code via SMS on your registered mobile number. Enter this code in the app’s designated area to confirm the transaction. It’s usually the next screen after tapping on the “Withdraw” button.

8. Confirmation of Successful Deposit

Once verification is successful, Equity Bank will send you an email confirming that funds have been deposited into your Equity Bank account. You may also get a text message confirming this transaction.