NCBA Group has unveiled a new mobile application dubbed ‘NCBA Now’ that the company says is going to elevate customer experience to another level. The bank expects the new mobile application to enhance its efforts in becoming even more accessible and offer its customers a more efficient usability experience as well as a ton of its current services.

The bank expects the new mobile application to increase its standing in the current banking space to even higher heights since it showcases its enhanced approach to fostering financial inclusion as well as presenting customers with unrivalled experiences. The app encompasses innovative digital solutions that are customized to meet current and emerging needs.

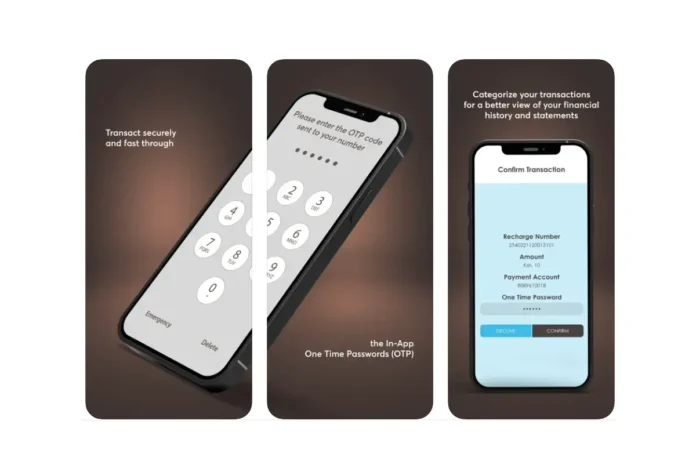

NCBA Now will offer a range of services that are customized to enable customers have access to a number of solutions in real time such as account monitoring, seamless card management, streamlined service requests, customizable alerts, diverse money transfer options, hassle-free bill payments, and instantaneous mobile wallet transactions which will all be accessible at the touch of a button.

John Gachora, who is the current Managing Director of NCBA Group, stressed on the institution’s digital-first approach where he indicated that it was dedicated on to leveraging technology in driving financial inclusion across the East African region. Additionally, he reiterated the bank’s resolve to address customer challenges while delivering tailored financial solutions that resonate with market demands.

Customers can download the newly launched app from respective app stores – Google PlayStore for android users and the App Store for iOS users. Just head over to your respective app store and search for ‘NCBA Now’ and proceed to tap on download so that it’s downloaded and installed on your device.