Old Mutual Group has partnered with KICD to roll out a pioneering online financial literacy program targeting junior and senior school teachers in Kenya. This is part of a bigger initiative through which to integrate financial literacy into the current Competency-Based Curriculum from pre-primary to senior school.

Addressing Financial Literacy Gaps

This presents a significant challenge for Kenya in regard to financial literacy since most citizens are not equipped with key skills for managing their financial resources. This has been further compounded by research that has established the value of early financial learning and that both highly engaging digital and non-digital resources can be beneficial in increasing the quality of teaching financial concepts.

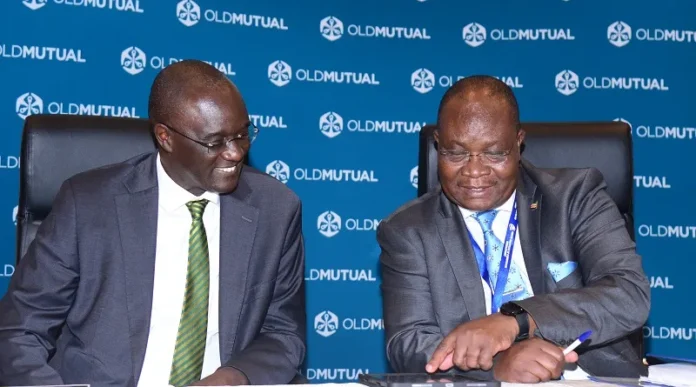

According to the CEO of KICD, Prof. Charles Ong’ondo, Old Mutual Group has continued to be committed to the societal transformation agenda through investment in education. He indicated that the financial literacy program followed a very successful pilot phase where 120 junior secondary school teachers were trained in 36 schools from Uasin Gishu, Makueni, Laikipia, Siaya, and Kiambu counties. “The learning gaps identified during our pilot informed the extent to which financial literacy could be infused into other learning areas,” said Ong’ondo.

Improve Financial Literacy

Group Chief Executive Officer of Old Mutual, Arthur Oginga, underscored the integral part financial management skills play in a country’s growth and development. He noted that it would have to introduce financial literacy lessons at the school level, with a view to setting generations to come on the right path. “We are ready to work with all relevant partners to ensure we have a generation of financially sound minds,” noted Oginga.

Old Mutual has injected Kes25 million into the programme and achieved several milestones in the process, among them: integration matrices and guidelines in 2021; online orientation courses for financial literacy teachers in 2022; a pilot programme in 2023; a financial literacy toolkit for students in 2024. More Reach Through Digital Platforms

Junior school teachers can now enroll in the online program, with plans to include senior secondary school teachers from the year 2026. The training will be on Elimika, a cloud-based training platform offering capacity-building courses on all subjects under the sun.

He said the institution had developed a new online platform that was going to enhance the delivery of this curriculum on money matters. “We are glad to roll out this program that is going to empower all teachers in Kenya to teach financial literacy effectively,” he said.

Oginga indicated that the programme also dovetails with Old Mutual’s community investment strategy, which has a strong focus on financial education and literacy. Adding to this is the Old Mutual Lengo Education Plan, a long-term savings product offering life cover, emergency funding, bringing relief and tax benefits for the policyholder.

This collaboration between Old Mutual and KICD becomes very fundamental in delivering financial literacy to the youth in Kenya so they can be empowered with the knowledge and capability for their safety in financial terms.