The fear of MPESA reversals in small businesses, mainly matatu and boda boda operators, has greatly made an impact on the rise in using Safaricom’s Pochi La Biashara service. This new solution has seen a big increase with registered tills reaching 632,681 by end of March this year. It is more than double from last year’s same period when there were 292,634 tills registered at that time.

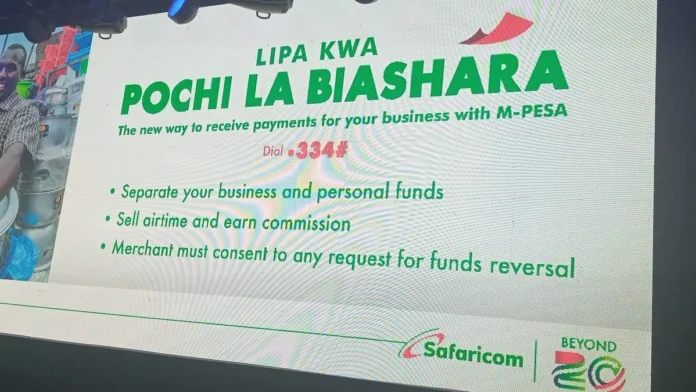

Pochi La Biashara is a key tool for small business owners because it helps them to keep their business cash separate from personal funds. The main advantage of this service comes from its inherent feature that prevents customers from reversing transactions, which was a growing concern as more Kenyans started making payments to merchants’ mobile lines. This important feature deals with an old problem where entrepreneurs were at risk of getting fake requests for reversals.

Pochi La Biashara is getting more popular, and the number of users is almost the same as active Lipa na M-Pesa merchants. During the review period, Lipa na M-Pesa merchants grew by 4.3 percent to 633,009. Both these solutions are fundamental parts of Safaricom’s M-Pesa platform that helps in making transactions easier as well as in increasing revenue for Kenya’s largest mobile service provider.

Pochi La Biashara was born in 2020, it came at a time when the world was dealing with Covid-19 pandemic. It’s the same period that witnessed Kenyans favor mobile money cashless transactions instead of cash handling mainly to stop spreading the virus. For many small businesses who lack Lipa na M-Pesa lines, Pochi La Biashara becomes an important alternative by providing them with a special wallet for receiving payments safely. The choice from Central Bank of Kenya to not charge fees on transactions under certain limits made using mobile payment systems more attractive. This includes paying for essential services such as matatu fares.

Before Pochi La Biashara, small businesses had to confront different issues such as asking customers to pay for withdrawal charges or depending on M-Pesa agents in order to withdraw cash. Additionally, the inclusion of Fuliza – a mobile overdraft facility – also incurred extra deductions on funds received. With Pochi La Biashara these barriers were removed; it gives more power over money matters to business owners and makes clearness better by offering account statements that can be easily accessed.